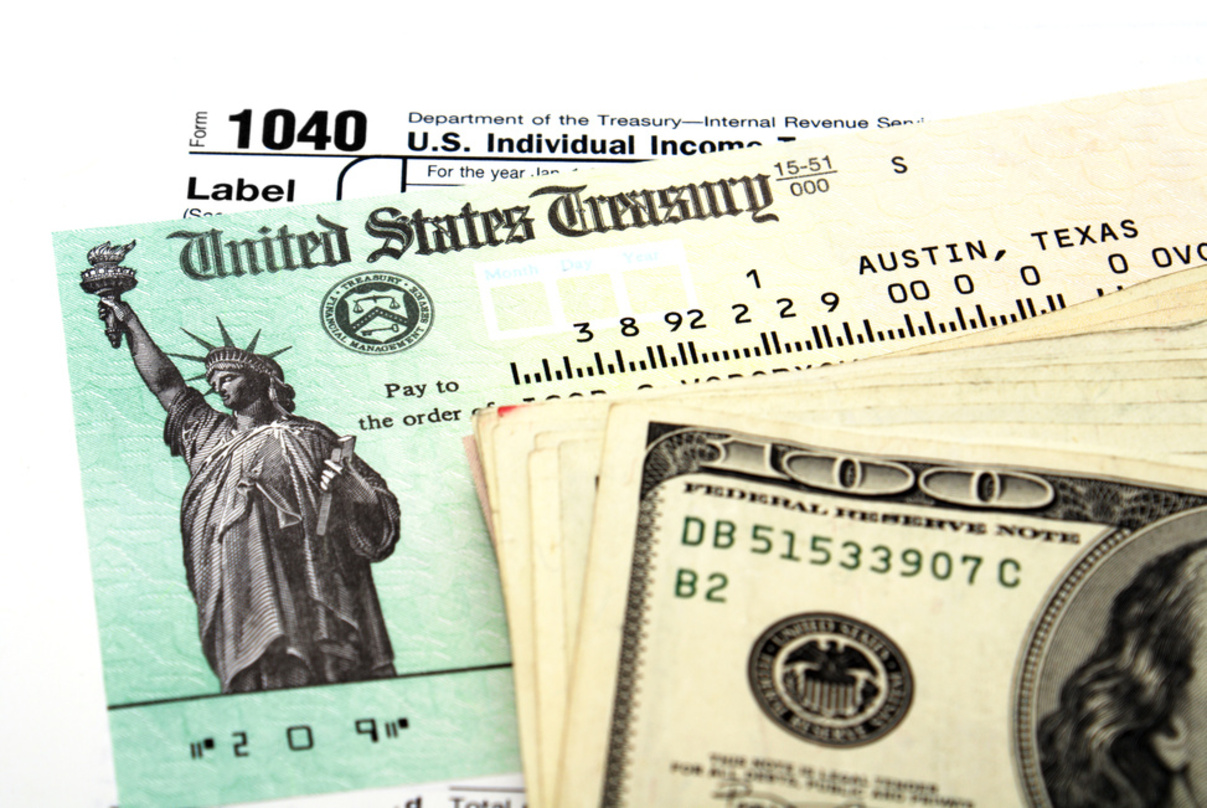

If I gave you a stack of twenty-six hundred-dollar bills, you’d be pretty happy, right? You might wonder where I got all those crisp, unmarked, nonsequential bills, but you’re not gonna look a gift horse in the mouth, amiright?

You might even start imagining how you’re going to spend this windfall. Tickets to Maui, a new computer, paying off that credit card… you and Benjamin have plans.

Then I tell you I’ve been sneaking $100 out of your wallet every two weeks for the past year. I just handed you back a fistfull of your own money.

You’re not as happy with me now, are you?

Every year, we get excited when we get a tax refund. We treat it like found money. The bigger the refund, the happier we are. If it’s less than we expected, or —gasp!—we owe money, it puts us in a bad mood.

From a purely mathematical standpoint, getting a large tax refund is a terrible idea. “It’s like you’re giving the government an interest-free loan.” That’s technically true, but that’s not the part I’d worry about. If you invested that biweekly $100 into a money market account paying 2%, at the end of the year, you won’t have earned a full dollar in interest. Even if you’re paying off higher-interest debt, the difference is just a few bucks. Not a game-changer.

The more important thing is that you could put that money to better use than the government can. A tax refund of $2,600 is like having an extra $100 in your paycheck every two weeks. What could you do with an extra $100 in your paycheck?

Four out of five families live paycheck-to-paycheck. They’re barely making ends meet. Give them an extra $100 per paycheck, and pretty soon they’ve got a $1,000 starter emergency fund.

But personal finance isn’t about math as much as it is about behavior. When you realize there are humans involved here, the preference for getting a large refund makes a little more sense.

- Err on the side of a refund. If you underpay your taxes, you may owe a penalty. Nobody wants to pay a penalty, so it’s safer to overpay and get a refund.

- We’re not disciplined. A lot of people have a hard time saving, investing, or paying down debt on a regular basis. Give them an extra $100 in their paycheck and they’re just going to spend it. Having it witheld from their paycheck is a form of forced savings plan for them. Fair enough.

- Big numbers feel more significant. Whatever your financial goals are, chipping away at it with $100 every paycheck might just not feel like you’re getting anywhere. But when you’re throwing $2,600 towards your goal? Now it feels like you’re doing something!

You’ll see plenty of articles about why getting a large refund is a bad thing. My advice: don’t sweat it. As long as you have a plan in place and follow your plan when you get your refund, it doesn’t matter how big your refund is. As my grandmother would say, it all comes out in the wash.

If you can handle the responsibility of another $100 in your paycheck and don’t want to wait until tax season to get your own money back, there are a couple things you can do. Talk to your Payroll department about adjusting the witholdings on your W–4. Talk to your accountant or tax preparer about how to revise your quarterly estimated tax payments. You can always review and adjust mid-year.

If you’re the kind of person who likes the forced-savings aspect of a large tax refund, remember you can have savings, investments, and even debt payments happen automatically, either by automatic withdrawal or even payroll deduction.

If you’re the kind of person who wraps your own presents and sticks them under the tree just because you like opening presents, you can send the IRS a check anytime and they’ll send you a refund in April. Knock yourself out.

We shouldn’t get any more excited about an income tax refund than we get when the cashier at the grocery store gives us our change. We’ve paid for a product or service and now we’re getting back the amount that we overpaid. Nothing less mundane than that.

But it is nice to hold $2,600 cash in your hand.

Question: Do you prefer a large refund? Or do you see how close to exact payment you can get? Share your thoughts in the comments, on Twitter, LinkedIn, or Facebook.