The best way to get out of debt is through focused intensity. Line up your debts and pick one. Throw everything you can at it until it’s paid off while making minimum payments on the rest. Repeat until you’re out of debt.

But here’s a question: in what order should you pay off your debts? Mathematically, you should start with the highest interest rate to minimize the amount of interest you pay. Behaviorally, you should start with the smallest balance to see some early success, build confidence, and build momentum. Emotionally, one of the debts may be more annoying than the others. Psychologically, paying off secured debts first might restore your sense of Safety faster.

Pragmatically, there may not be much of a difference. If you’re ready to get out of debt, you may be wondering which approach to take. Let’s take a look at paying off the smallest balance first and highest interest rate first (they’re the easiest to model) and put some numbers to them.

First, we’re going to need some debt:

- Mastercard — $2,500 at 19%

- Visa — $7,500 at 13%

- Car Loan — $4,000 at 8%

- Student Loan — $1,900 at 5%

I’ve taken these numbers from Paula Pant’s article on Debt Snowball vs. Debt Stacking. Her conclusion? If you start with the highest interest rate first, you’ll save money on interest but it might take a while to see some results. If you start with the lowest balance, you’ll get a sense of victory sooner but you’ll pay for it through more interest. That makes sense. There’s obviously a trade-off here between time and money.

Paula doesn’t say what the payments on the debts are, so we need to make some assumptions. Let’s assume that the credit cards have a minimum payment of 2% of the balance or $25, whichever is more. That’s fairly typical of how the minimum payments are calculated. That gives us a current payment of $50 on the Mastercard and $150 on the Visa. The car loan and student loan have fixed monthly payments of $100 and $25. Our total monthly debt repayment budget is just $325.

If we were serious about getting out of debt, we’d throw everything at it we could. We’d cut back on our spending for a while so we could pay off the debts as quickly as possible. For our purposes today, we’re going to just use that $325 monthly budget; that will make it easier to see the difference in the results. (It’s called controlling for variables.)

Meet the Stackers and the Ballers, two couples who have the exact same debt. They’re going to make the minimum payments on all debts. As the balances go down, cash will be freed up. That extra cash is going to be applied to the first debt on their list.

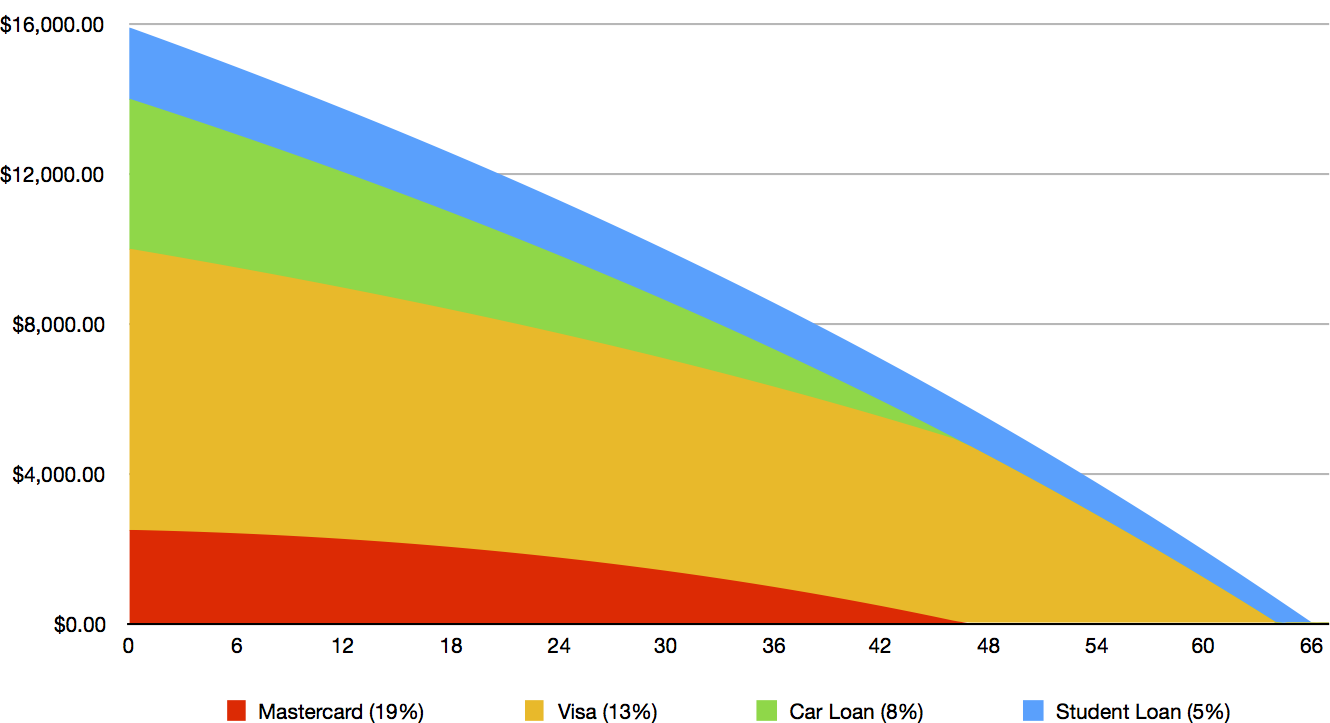

Pay the Highest Interest Rate First

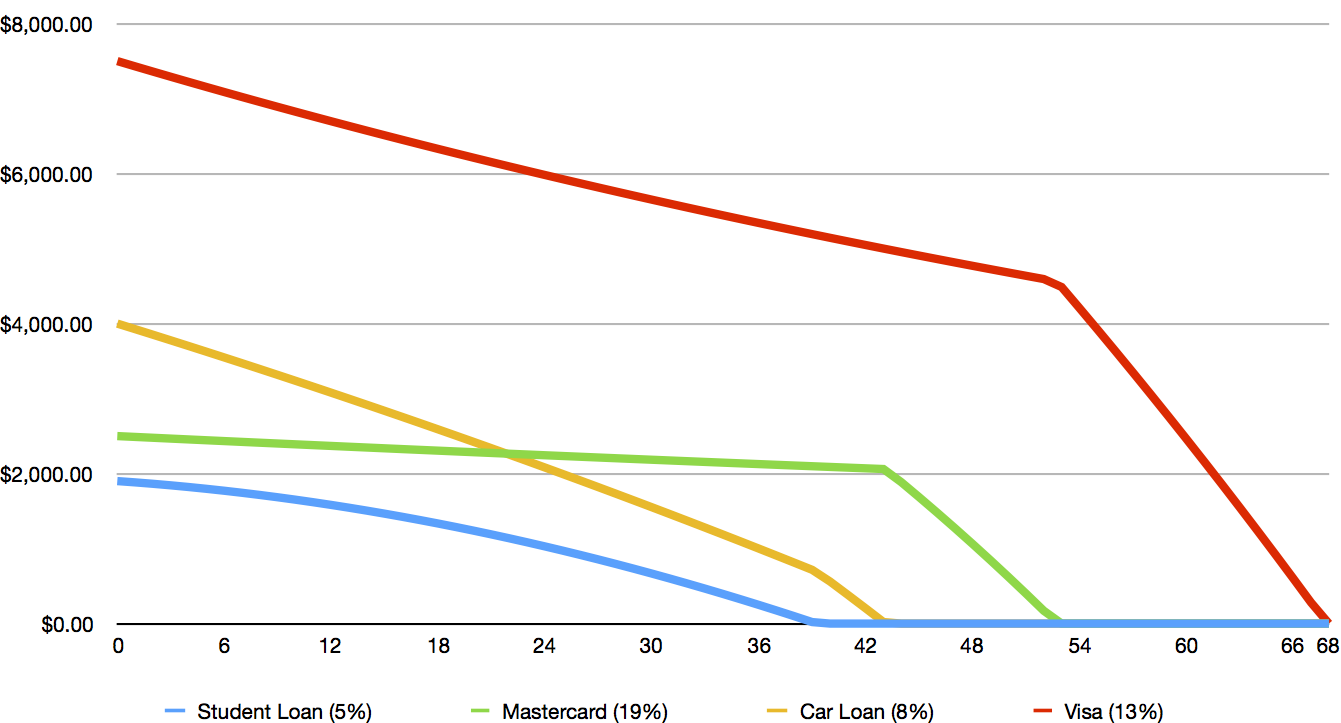

The Stackers follow the mathematical approach of paying off the debts with the highest interest rate first. They will pay off their debt in 67 months after paying a total of $5,590 in interest.

The Mastercard and car loan both get paid off after 47 months. Then the focus shifts to pay off the Visa 18 months later. The student loan lingers until the Visa is paid off, then gets paid off in just over a month.

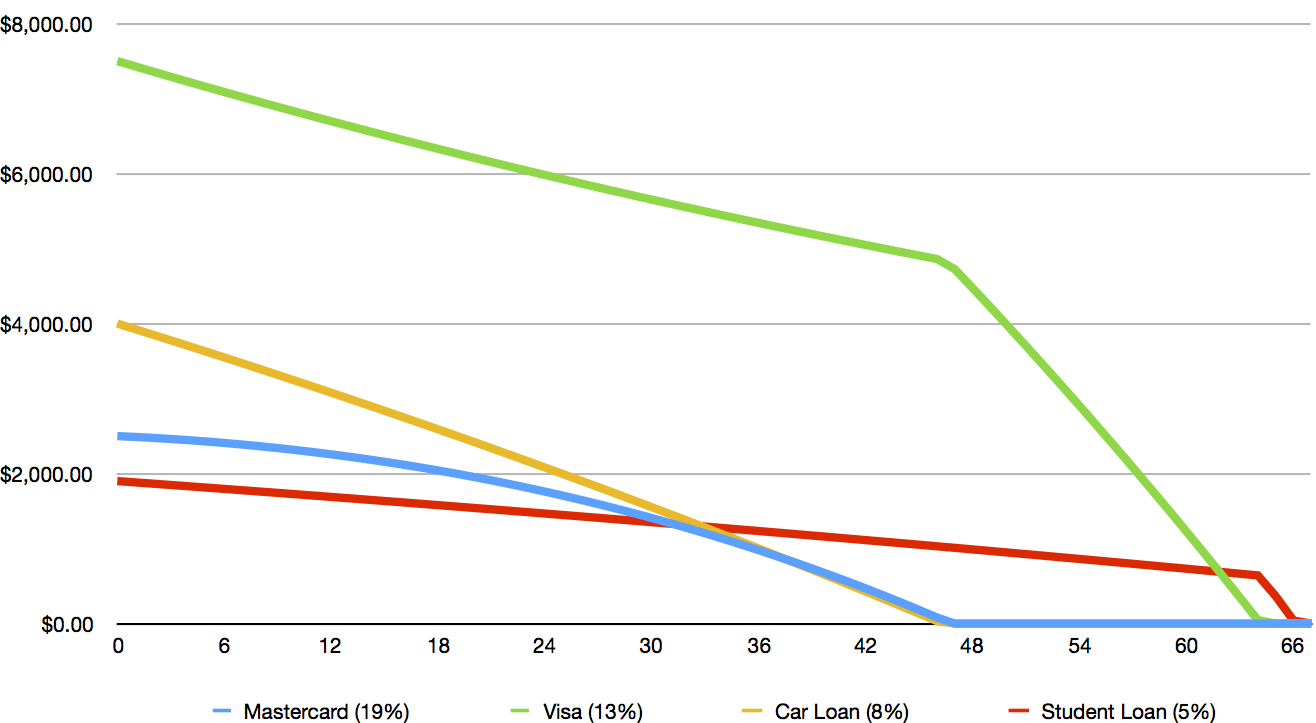

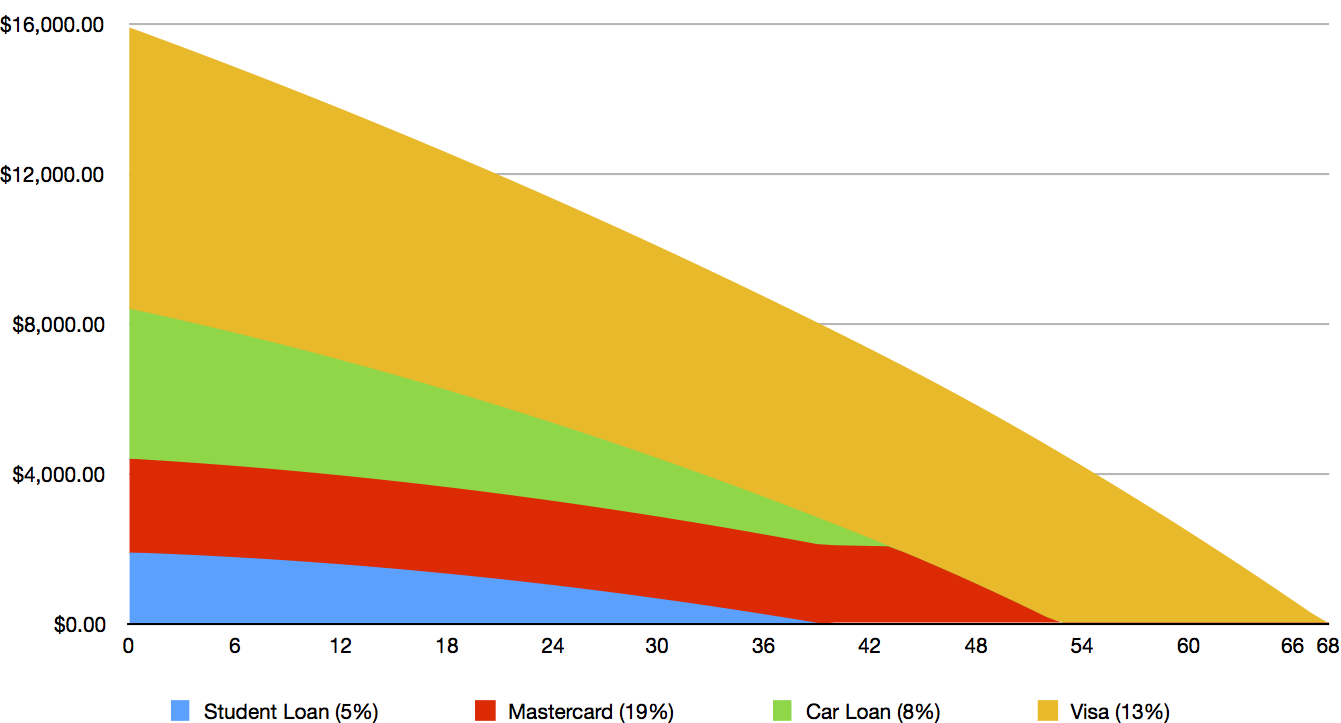

Pay the Smallest Balance First

The Ballers follow Dave Ramsey’s recommended approach and start with the debt with the smallest balance. They will pay off their debt in 68 months after paying a total of $6,155 in interest.

The interesting thing here is that the focused account changes! Although the car loan starts with a higher balance than the Mastercard, it gets paid down more quickly. After 22 months, less is owed on the car (though it doesn’t make a difference until the student loan is paid off).

Compare and contrast

Not a lot is different between the two approaches. Paying off the higher interest rate first resulted in paying off the total debt sooner (1 month) and paying less interest ($565). Paying off the smallest balance first resulted in paying off the first debt sooner (40 vs. 46).

So should you pay off the debts with the highest interest rates first?

I’d still recommend paying off the smallest debts first.

I can hear some of you objecting apoplectically. “But you just confirmed that you’ll pay less interest if you pay off the highest interest rates first!!” Sure. In an ideal, mathematical example.

I also just proved something else: mathematically, it doesn’t make that much of a difference. One month. A couple hundred bucks. Don’t get hung up on which debt to pay first. Pick one. Attack it. The more you can throw at it, the faster you’ll be out of debt.

Personal finance isn’t about math. If it were, we wouldn’t get into so much debt in the first place.

Personal finance is about behavior. Can you create and stick to a monthly budget? Can you delay gratification? That’s going to determine your success with money more than math will.

Question: What motivates you to be debt-free? Share your thoughts in the comments, on Twitter, LinkedIn, or Facebook.